Interview with

Ms. Cristina Galhardo

Head of Special Cargo

See key takeaways of this interview at the end.

For starters Cristina can you tell us about the background, history and ownership of Interoceanica?

CG: Of course! Interoceanica was created in 2002 by its owners (Washington Barros, Fabiano Rodrigues, Marcos Marinho, Rene Steinmann and Wayan Barros), together with BBC do Brasil (representing BBC Chartering in Brazil), with the help of our current general manager, the highly experienced Carlos Dohnert. Since its beginning as a freight forwarder, Interoceanica’s initial function was to assist the tube market, addressing Vallourec’s growing need for a management service over its export demands. We are happy to say that Vallourec remains with us to this day.

Being well-established in the local market, we also started working with other types of cargo, including bulk, general, and project cargo.

It is important to note that, although Interoceanica and BBC do Brasil share the same shareholders, they are distinct and completely independent companies, each with its own customers, vendors, and assets. In other words, Interoceanica can work with all carriers in the market, just like any other company, not exclusively with BBC.

Today, Interoceanica has five offices in Brazil: Rio de Janeiro (HO), São Paulo, Belo Horizonte, Fortaleza, and Natal. We also have an office in Miami, FL.

Brazil has many freight forwarders also claiming to be good at project cargo. How would you describe to our international readers the strengths of your company?

CG: Due to the company’s 23-year history and solidity, our customers and partners can rely on highly experienced professionals responsible for their shipments, all of whom have well over 20 years in the shipping market, including Rene Steinmann, Carlos Dohnert, and myself, alongside our team of engineers and heavy haul transportation specialists.

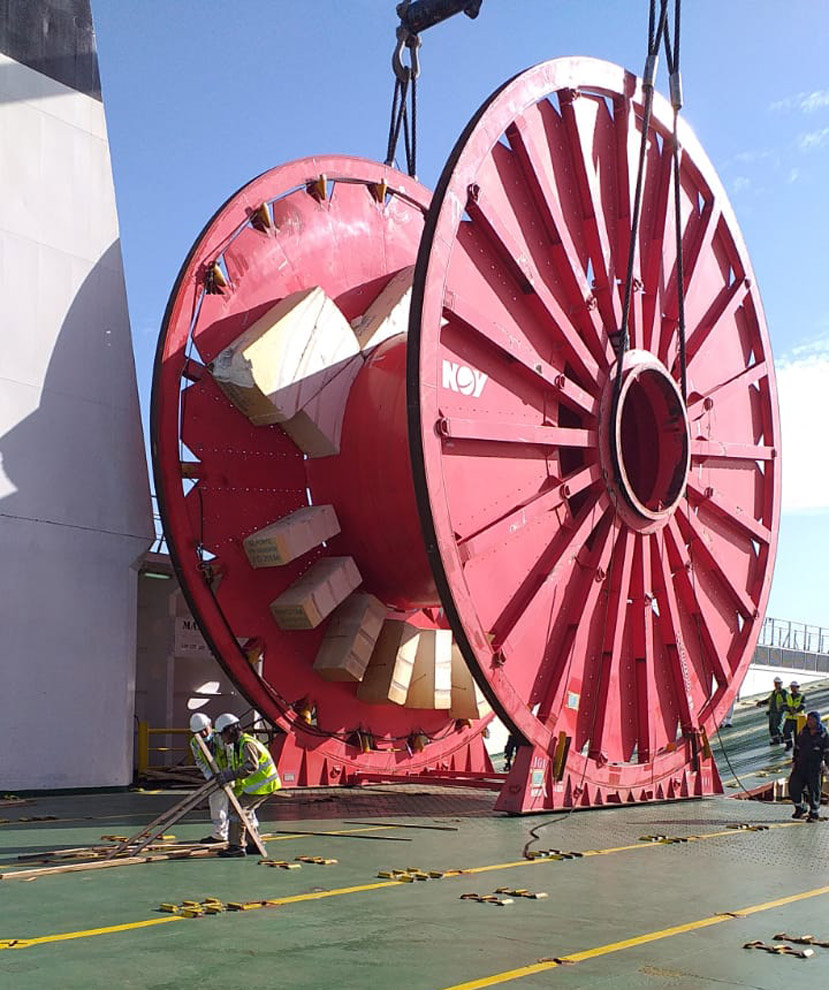

Additionally, Interoceanica has several partnerships in the local market, enabling our team to actively operate as a trucker and heavy hauler, with direct rental and administration of assets such as MTRs, gantry cranes, low beds, jacking and sliding equipment, etc. Everything is managed in-house, with excellent insurance coverage and ISO certifications. We are in the process of obtaining AEO Certification, which should be confirmed very soon.

There are many ports in Brazil. Could you elaborate a bit on the ports most commonly used for breakbulk and project cargoes? Also, in a country as big as yours, I suppose that some ports are more well-equipped than others? What is your experience on this?

CG: I’d say that there are reasons beyond equipment structure that will define which port you will use in Brazil.

Due to our geography, the location—alongside route feasibility—plays a significant role for different regions of Brazil: Paranaguá for the South, Rio/Itaguaí for the Southeast, Salvador and Pecém for the Northeast, and Manaus for the North.

Santos used to be a very important port for our market, as it is close to the country’s most important factories. However, the concessionaire responsible for the access road to the port has made transporting special cargo very expensive, opening a competitive corridor for Rio de Janeiro and Itaguaí, where access road transportation costs are lower than those for Santos, even though the distance is slightly longer. Because of that, Santos is now more of a general cargo and bulk port. We don’t know if we will be able to use it for breakbulk cargo in the near future, unfortunately.

From an equipment perspective, some ports are certainly better equipped than others, with Vitória standing out due to its high-capacity cranes. Due to the high investment costs for equipment and maintenance, most ports prioritize container cargo, leaving little room for project/breakbulk cargo. As a result, most of them only offer storage areas, with cargo handling often falling under the responsibility of customers or freight forwarders.

Inland transport in Brazil—is that mainly done by road, rail or barge? Could you also provide us with some examples of cargoes that you have handled in the past?

CG: In general, Brazilian inland logistics is primarily road-based. Unfortunately, government investments in river and rail transportation are almost nonexistent, which is a pity. However, barge transportation is also used for local seafreight when route feasibility for super heavy and/or oversized cargo is lacking. In the Northern region, it is widely used due to the area’s rich river network.

Interoceanica has already undertaken many projects, including seafreight, port handling, and inland transportation of heavy coils, off-road trucks, giant buckets, transformers, windmills, rotors, turbines, and many more to come!

Customs clearance was (to my former knowledge at least) often a headache in Brazil. How is the situation now? Any good words of advice to an overseas shipper or forwarder wanting to ship to your country? Is customs clearance always done at the first point of entry?

CG: I see that Brazilian authorities are gradually trying to modernize and speed up the local clearance process (it has improved significantly since I started working), but it is still far from ideal. The key to success is always relying on a trustworthy partner who will prepare and check all the details—both cargo and documentation—while the shipments are still at their point of origin or supplier’s factory. This applies to all shipments, whether breakbulk/project cargo or not. When the process starts correctly, and the cargo is properly packed, marked, and manifested, many problems can be avoided, and the chances of a successful process are greatly increased.

For projects, prior study and preparation are even more crucial! Some duties and tax benefits/exemptions can be applied in certain cases, and alignments with the local customs office should be made months before the project begins, as these requirements can take time.

Port terminals in Brazil are currently very congested, and the demand for storage space—along with backlogged customs processes—makes port back-up areas or even bonded terminals in the countryside better options for faster customs clearance. The choice depends on cargo requirements, awarded tax benefits, customs process options, location, and feasibility of transfer costs from the port. This should also be checked in advance.

Nowadays some of the shipping lines pretend that they are capable of being freight forwarders. In other words, you contact them with a shipment, book it and immediately after they will call your customer directly. Is that happening in Brazil, too, and do you then avoid these shipping lines?

CG: For sure, it happens a lot here! We see that more and more, we are competing with these “shipping lines” in the market. I quote/use their services only when working with containers. For breakbulk (BB) cargo, they can easily track the kind of cargo and POL, as well as the customers of the request. Container businesses are not that trackable.

COSCO Shipping Ports opened a new LATAM hub in Peru called Chancay. Might this route be interesting for cargo coming from inland Brazil but destined for Asia? What is the current inland situation in Brazil connecting to the West Coast? Or are we perhaps still years away for this solution?

CG: It is always good to have options and out-of-the-box solutions, but speaking of project cargo in Brazil, unless there are improvements in road and river infrastructure between Brazil and Peru, along with potential agreements to enhance this route, I do not see Chancay as a viable alternative for out-of-gauge (OOG) cargo producers—most of whom are in the southeast of Brazil. I hope the governments can work together on this idea and perhaps further develop industries in this corridor.

How is it best for our readers to get in touch with you?

CG: I’ll be more than glad to be reached for business development or a nice chat though any of the channels below:

Phone / Whatsapp:+ 55 11 98344-8228

Email: cgalhardo@interoceanica.com.br